Aion Finance

Trade Smarter with Market Memory

Aion Finance analyzes past market conditions to uncover high-probability, high-reward trading strategies. Backtested insights. Data-driven trades. Historical edge.

Meet Aion

How It Works

Build or Select a Strategy Model

Create your custom framework or choose from expert-built models based on volatility profiles, technical indicators, or both.

Identify Matching Historical Periods

Our algorithm scans market history to find the most similar environments to today, based on your model’s criteria.

Discover the Top Performing Trading Strategies

Identify high-expected-return strategies proven to outperform during similar market conditions

Who Aion is For

Built for Precision. Powered by Data.

Extensive Indicator Library

Build precision-driven models using a wide range of technical indicators, volatility measures, and time filters. Whether you're modeling breakout patterns or volatility compressions, Aion lets you define the exact market behavior you want to analyze.

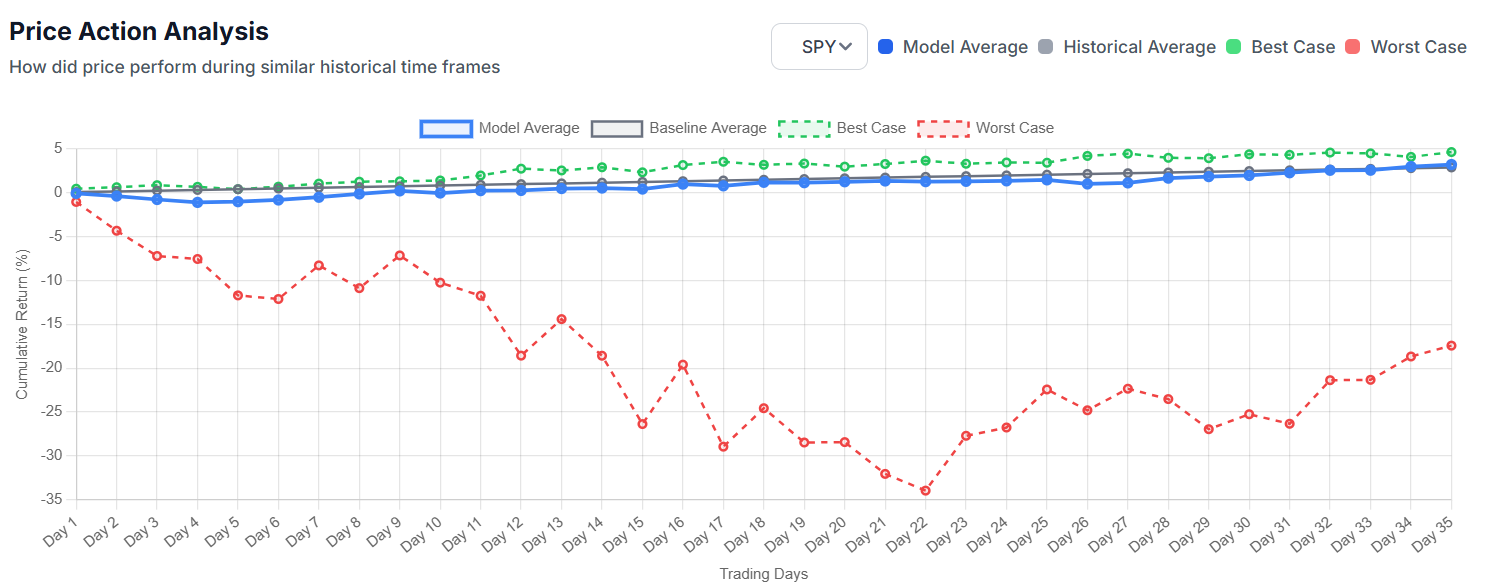

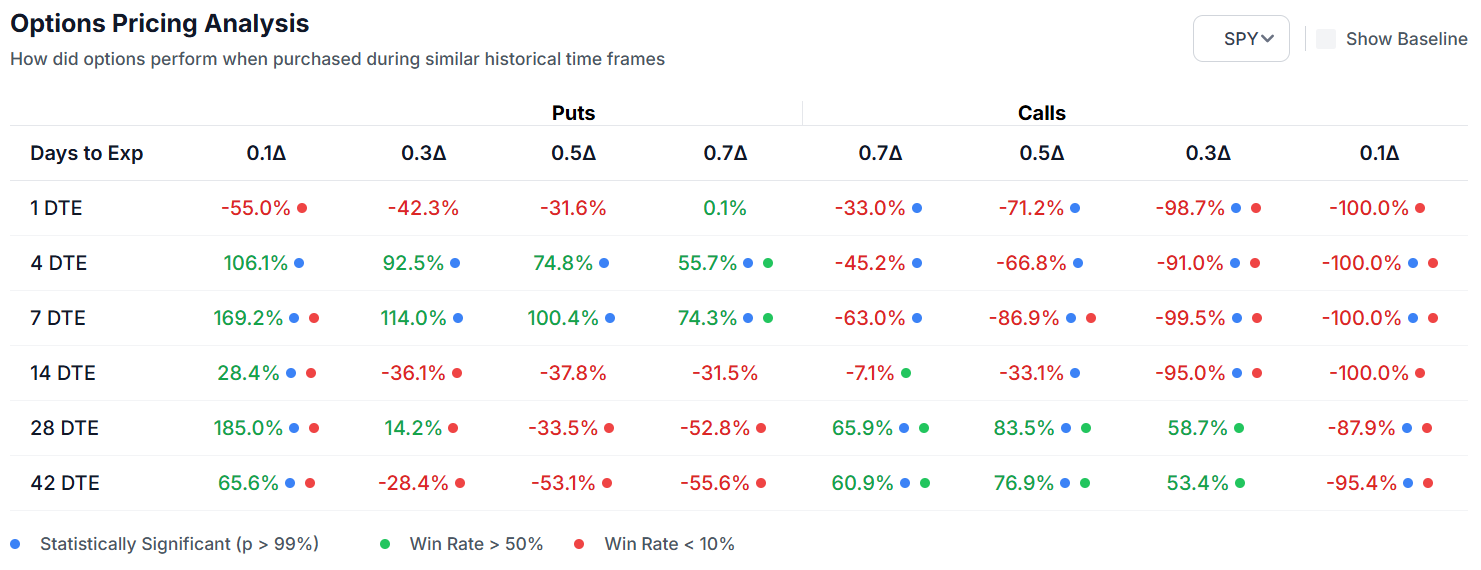

Outcome Grid from Historical Matches

Visualize potential outcomes before you place a trade. Aion shows a performance grid of top strategies that worked in historically similar environments—so you can compare risk, reward, and probability across different options plays.

Individual

Quant Power for the Self-Directed Trader

# of indicators

100s

# of models

unlimited

Support

24/7

$99.99/mo

Get StartedInstitutional

Custom Analytics for Institutional Edge — Get in Touch.

Enquire

Contact Us

Insights Backed by Data. Loved by Traders.

"When the market’s selling off and every instinct says 'get out,' Aion gives me data I can trust. It finds similar setups from the past and shows me how those moments played out—so I stay grounded and often end up on the right side of the trade." - Part time options trader

"What I love about Aion is how it shows what to options to buy and sell. I can create complex strategies with confidence because it gives me multiple ways to win, maximizing my risk reward. It’s a serious edge." - Full time trader

Case Study: Trading during times of conflict

Cutting Through the Panic

Markets often react with fear to Middle East conflict headlines, but our analysis shows these drops are usually short-lived. Traders who stay focused on data—not emotion—can spot high-probability opportunities in the chaos.

Strategies for Volatile Markets

Selling short-term puts and buying longer-dated calls has historically outperformed after conflict-driven selloffs. Diagonal call spreads are especially effective in capturing both premium and rebound potential.